Our content is funded in part by commercial partnerships, at no extra cost to you and without impact to our editorial impartiality. Click to Learn More

Our research finds that QuickBooks is a stronger accounting tool than Wave, offering the best set of features we’ve reviewed, including standout budgeting and inventory management functions.

However, if you’re just after a simple bookkeeping tool to manage your finances, Wave will do more than meet your needs. The accountancy software is fuss-free, easy to use, and it’s completely free – unlike QuickBooks, which has an entry price of $30 per month (or $15 per month for the first three months with the provider's current deal). This makes Wave an ideal tool for managing the finances of small businesses and side hustles.

Both QuickBooks and Wave excel in different areas, so scroll down to find out how the two solutions compare when it comes to accountancy features, advanced capabilities, affordability, and support. Still open to other options? You can also use our comparison guide to see how the providers fare against their competition, or check out our table below.

Wave & QuickBooks vs Alternatives

| Price from | Free trial | Core Benefit | Deal | ||||

|---|---|---|---|---|---|---|---|

| FEATURED DEAL | |||||||

| Patriot Accounting | QuickBooks | Xero | Wave Financial | Zoho Books | FreshBooks | Sage | Kashoo |

|

|

|

| |||||

| | | | It's free, no trial needed | | | | |

| Being an all-in-one, easy to use solution | A broad range of accounting features, professional look and feel, helpful and free trial period | Online integrations | Tracks money owed at a low cost | Strong automation features | Great features; a simple, slick interface; and a competitively low price | Very user-friendly | Easiest setup |

| Save 50% for three months | No active deals | No active deals | No active deals | 60% off for six months on all plans | Save 70% for six months | No active deals |

After putting leading software through their paces we found QuickBooks was the best accountancy tool overall, while Wave is the most wallet-friendly.

However, they won't meet the needs of every business. If you manage a hospitality business, we could recommend using Xero because of its handy budget creator tool and slick POS integrations. Alternatively, Zoho Books is the best low-cost tool for billing clients, thanks to its generous invoice limits.

Check out our full guide to the best QuickBooks alternatives.

Wave vs. QuickBooks: Key Takeaways

Here's a quick summary of how Wave and QuickBooks compare:

- QuickBooks has versatile applications (with an advanced feature score of 4.5/5 compared with Wave's 0/5), while Wave is only capable of basic accountancy functions.

- Wave Accounting is completely free to use, while QuickBooks' pricing plans start at $30 per month.

- QuickBooks offers 24/7 support for its Enterprise users via phone, live chat, and email, whereas Wave's chatbot, Mave, is only open from 9am to 5pm, Monday to Friday.

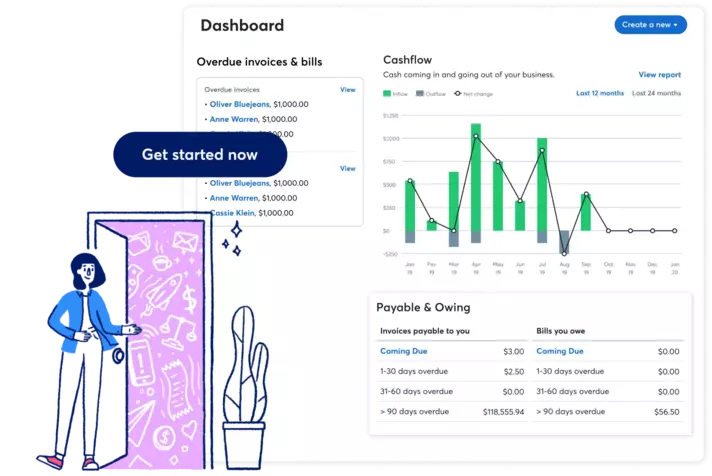

- QuickBooks offers financial projection tools on all tiers, while Wave completely lacks budgeting and cashflow tools.

- Both Wave and QuickBooks offer receipt scanning apps, but QuickBooks lets you scan other documents as well.

While Wave and QuickBooks both sit at the top of their game, they corner different areas of the market.

QuickBooks is a comprehensive accountancy tool that can help you out with just about any function imaginable, from batch importing and payroll processing to KPI tracking. This makes it better suited to businesses with complex accountancy requirements than Wave, which lacks some basic features like stock tracking and budgeting.

However, if you're after zero-frills accountancy software that can help you handle the basics, Wave will be more than enough. While it lacks the bells and whistles offered by QuickBooks, its feature set is nothing to be snubbed at, and the tool is completely free to use, making it perfect for users who are looking to keep costs low.

| Best for | Tech.co review score | Price from | Free trial | Core Benefit | Pros | Cons | Key features | Try now | ||

|---|---|---|---|---|---|---|---|---|---|---|

| QuickBooks | Wave Financial | |||||||||

| Best for small businesses | Best free option | |||||||||

| 4.7 | 4.0 | |||||||||

| | It's free, no trial needed | |||||||||

| Unbeatable range of accounting features and some truly good value plans for growing businesses | Tracks money owed at a low cost | |||||||||

|

| |||||||||

|

| |||||||||

| ||||||||||

| Try QuickBooks | Try Wave today |

When it comes to affordability, there really is no contest —Wave offers better value than QuickBooks. Wave is completely free, requires no contract, and doesn't feature any hidden fees, while QuickBooks starts from $30 per month on its Self Employed plan. This is why we've awarded Wave a perfect value score of 5/5 in our in-depth research. It is also the best value rating we've handed out across the accountancy software category.

In contrast, QuickBooks offers five software packages with a price cap of $200 per month and no free option — earning it a lackluster value score of 3/5. However, while QuickBooks may be pricier than Wave, all of its tiers include stand-out features, including project accounting and budgeting tools, which provide a decent return on their investment to businesses with advanced accountancy needs.

You can learn more about the software's pricing structure in our QuickBooks Online pricing review.

Which has the best free plan?

QuickBooks doesn't offer a free plan, so Wave is the best option for businesses looking to manage their finances for free.

Free accountancy tools like Wave can provide a lifeline to smaller businesses looking to keep overheads as low as possible. However, since the uses of freemium tools are capped, growing companies are better off opting for paid versions instead, as these unlock advanced functions and end up paying for themselves over time. But don't go in blind. Lots of providers, like QuickBooks, offer a free 30-day trial, allowing you to sample its features before committing to a contract.

Best for Accounting Features: QuickBooks

QuickBooks has a much stronger accounting toolkit, offering users a much wider selection of useful features than Wave. However, this doesn't mean Wave should be ruled out, as the software's feature package performed particularly well in our last round of testing. To see how the provider's stand-out features compare side by side scroll down to the end of this section.

When it comes to bookkeeping, both QuickBooks and Wave offer just about every capability imaginable, making it simple for businesses to record their transactions and carry out payroll activities. However, QuickBooks' ‘Live Bookkeeping' tool goes one step further by connecting small businesses with qualified bookkeepers to keep their books up to date, which is why we gave it a perfect bookkeeping score of 5/5, compared with Wave's 4.75/5.

Businesses can also use both tools to access income statements, balance sheets, and sales reports. But since Wave lacks custom reports, its financial reporting features are slightly less flexible, which is why we gave the provider a 4.2/5 in the category, compared to QuickBooks' perfect 5/5. Despite the differing price points between Wave and QuickBooks, their accounts payable and receivable features are essentially neck and neck too.

Check out the list below to compare the stand out features of each provider:

Wave:

- Customizable invoices

- Recurring billing

- Profit and loss reports

- Receipt scanning via iOS mobile app

- Expense tracking

- Journal entries

- Credit card integrations

- Automatic payment reminders

QuickBooks:

- Income and expense tracking

- Tax deductions

- Comprehensive reports

- Receipt capture

- Mileage tracking

- Budgeting tools

- Inventory control

- Bill management

- Project accountant

- Live bookkeeping tools

QuickBooks offers stronger accountancy features than Wave overall. However, it's important to note that lots of QuickBooks' enhanced tools, like stock handling and project profitability, are reserved for its pricier tiers.

Best for Advanced Features: QuickBooks

If you're in need of advanced accountancy features, choose QuickBooks over Wave. This is because QuickBooks offers a broad range of elevated capabilities, from live bookkeeping to stock control, earning it an impressive score of 4.4/5 for advanced features, making it ideal for sector-specific businesses, like retailers or restaurants. There is even a specific plan for nonprofits.

Wave, on the other hand, receives zero marks for advanced features as it lacks a number of fairly basic capabilities, including project accounting and cash flow projection. For businesses with complex needs, this will likely be a dealbreaker. However, if you're just managing a budding business or something on the side, Wave's minimal feature set won't set you back too much.

Best for Help & Support: QuickBooks

If you're in need of sturdy customer support, QuickBooks beats Wave, hands down. QuickBooks offers support via phone, email, and even live chat, and its Enterprise users even benefit from 24/7 assistance, which is why we gave it a near-perfect research score of 4.5/5 in the category.

Conversely, Wave has a handy chatbot called Mave which is available from 9 am to 5 pm Monday to Friday. However, its capabilities are limited and since it doesn't offer any around-the-clock, it's pretty useless for businesses operating outside typical working hours, earning it a tepid support score of 2.5/5.

Who should choose Wave?

- Small businesses

- New businesses

- Budget-conscious businesses

- Freelancers

- People with side gigs

- Businesses with low turnovers

Who should choose QuickBooks?

- Larger businesses

- Businesses that manage stock (retail, food businesses)

- Businesses looking for budget planning and cash flow projection

- Businesses with mid-to-high turnovers

- Businesses that would benefit from custom reports

Our Research and Testing: How We Scored Wave & QuickBooks

We don't use guesswork at Tech.co. Instead, we work closely with our in-house research and testing team to make sure we only make informed, useful suggestions. When comparing accountancy tools like QuickBooks and Wave, we focused on eight categories of interest, including varied criteria like bookkeeping tools, advanced features, and pricing factors.

After carefully evaluating provider data, we award each piece of software a rating out of five for each category, as well as an overall score. We use these scores to see how providers like Wave and QuickBooks weigh up side by side, and to gauge their suitability for different types of businesses, from multi-unit franchises to budding startups watching their bottom line.

Check out our research guide if you're interested to learn more about how we compare the top software and hardware solutions.

| Tech.co review score | Bookkeeping | Advanced features | Value for money | Financial reporting | Help and support | |

|---|---|---|---|---|---|---|

| QuickBooks | Wave Financial | |||||

| 4.7 | 4.0 | |||||

| 5.0 | 4.8 | |||||

| 4.5 | 1.0 | |||||

| 3.0 | 5.0 | |||||

| 5.0 | 4.2 | |||||

| 4.7 | 2.8 |

Verdict: QuickBooks vs Wave

Compared to QuickBooks which can cost as much as $200 per month for its Advanced Plan, Wave is completely free to use, making it perfect for smaller businesses looking to keep expenses low. And while we gave it a dismal 0/5 score for advanced features, it offers all the capabilities you need to get started too, including 5/5 bookkeeping features and quality invoicing integrations.

But QuickBooks and Wave aren't the only options available. If you're still open to other solutions, our handy comparison table will help you whittle down the competition in minutes. And, just like Wave, it's completely free to use.

If you click on, sign up to a service through, or make a purchase through the links on our site, or use our quotes tool to receive custom pricing for your business needs, we may earn a referral fee from the supplier(s) of the technology you’re interested in. This helps Tech.co to provide free information and reviews, and carries no additional cost to you. Most importantly, it doesn’t affect our editorial impartiality. Ratings and rankings on Tech.co cannot be bought. Our reviews are based on objective research analysis. Rare exceptions to this will be marked clearly as a ‘sponsored' table column, or explained by a full advertising disclosure on the page, in place of this one. Click to return to top of page